2,000 Canadian Businesses choose Keep each month

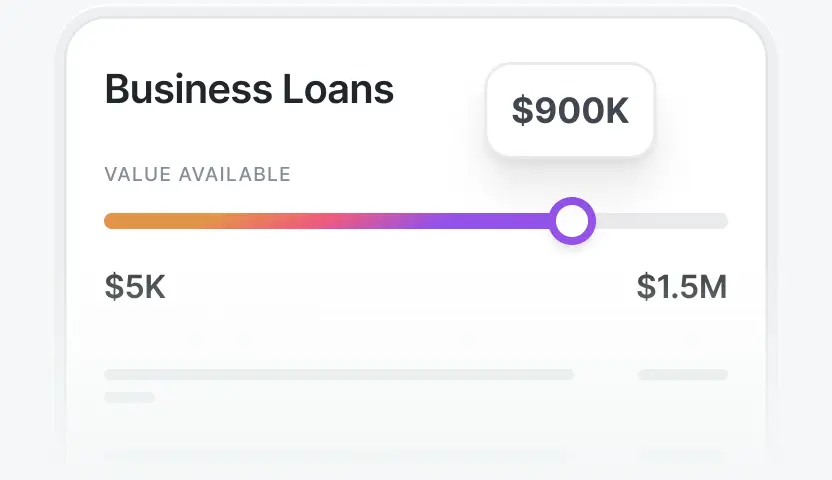

Borrow from $5K to $1.5M

Same day approval

Fair rates; As low as 8%, based on your business

Available to businesses with more than $10,000 per month in revenue

Why Keep?

One application - Multiple lenders. We give you the best deal, whether it's from Keep or another lender.

We're making finance honest.

We lend money at rates that aren't predatory

One application, 30+ lenders

If we can't finance you, we work with 30+ other lenders

We don't charge fees

We're not brokers. No loan origination fees.

Best offer guarantee

If our partners can offer you a better loan, we'll share their offer with you.

How it works

One application - Multiple lenders. We give you the best deal, whether it's from Keep or another lender.

Apply in Minutes

Minimal paperwork required. Just some business details, and your recent bank statement.

We review your loan

We might get in touch if we need to know a little more about your business.

Our partners review your loan

Up to 30+ other lenders review your loan at same time.

We surface the best offer to you

Even if it not us financing your business, we will always give you the best offer.

One platform

A range of funding solutions

Business Loans

One off lump sum for big or small business plans. From $5K to $1.5M.

Lines of Credit

Ongoing access to funds with interest only paid on what you use, and no monthly or annual fees.

Business Credit Card

More rewards than Amex and the Big 5 Banks and the most interest free days in Canada.

Frequently Asked Questions

Is my business eligible?

We work hard to find a funding solution for every Canadian business. Your businesses eligibility depends on a few factor;

- For most industries, 6 months trading history

- Minimum monthly turnover of $10K

- A minimum credit score of 560

- Incorporated in Canada

We're here to help, so feel free to get in touch and our team will check if you qualify.

How do I apply?

Simply complete our online form in as little as 10 minutes and get a decision within a business day – often just a few hours. For all applications, you'll need:

- Your driver's license, or other official identification

- Some basic business details

- Bank statements

- Some basic financial statements like a P&L and cashflow, for loan amounts above $150K

How much can I borrow?

The amount you can borrow depends on several factors, including the financial health of your business, revenue projections and creditworthiness. In our application form, we ask for how much you'd like to borrow. We generally try to offer you the maximum amount possible, and let you tell us if you need a little less.

What is the interest rate?

Interest rates for term loans range between 8% and 29%, cents on the dollar (This means the amount of interest paid ranges from $0.08 to $0.29 for each dollar borrowed).

When you apply for our business loan, we will assess the risk profile of your business and provide you with a customised offer including loan amount, term and interest rate.

We take into account your industry, how long you've been in business, your credit history and the health of your cash flow.

Are there any fees?

We don't charge any hidden fees. You can apply for a loan with Keep, with no upfront cost or obligation to proceed. We also don't charge for our best offer guarantee - where we help find you the best loan between Keep and other lenders, irrespective of who funds your business.

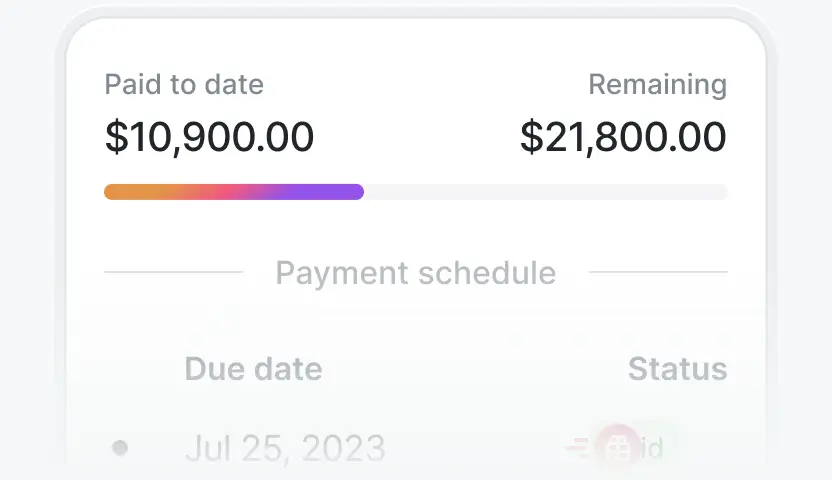

What are your repayment periods?

We have monthly, weekly, and daily repayment options for our loans. The frequency of payments depends on the size of the loan and the credit worthiness of your business.

If we deem a large loan is a little riskier, it's likely that both Keep and other lenders will offer a loan with more frequent repayment periods.